Brad Peltz is an American businessman and investor. He is the son of billionaire investor Nelson Peltz.

Brad Peltz is the founder and CEO of Trian Fund Management, a hedge fund that manages over $5 billion in assets. He is also a director of several public companies, including Mondelez International, Procter & Gamble, and Sysco. Peltz is known for his activism, and he has often pushed for changes at the companies he invests in.

Peltz is a graduate of the Wharton School of the University of Pennsylvania. He began his career as an investment banker at Goldman Sachs. In 2005, he founded Trian Fund Management. Peltz is married to Claudia Heffner Peltz, the daughter of former Playboy Enterprises CEO Hugh Hefner.

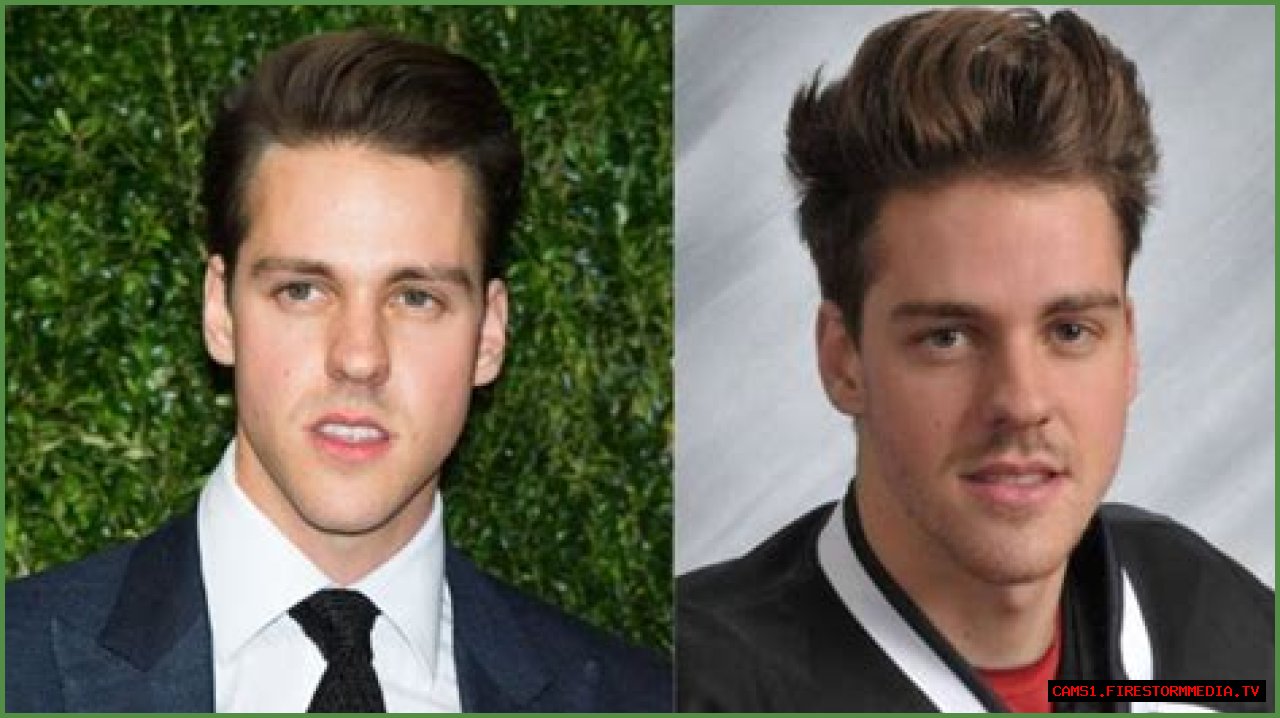

Brad Peltz

Brad Peltz is an American businessman and investor. He is the son of billionaire investor Nelson Peltz.

👉 For more insights, check out this resource.

- Founder and CEO: Trian Fund Management

- Director: Mondelez International, Procter & Gamble, Sysco

- Activist investor: Pushes for changes at companies he invests in

- Graduate: Wharton School of the University of Pennsylvania

- Former investment banker: Goldman Sachs

- Married to: Claudia Heffner Peltz, daughter of Hugh Hefner

- Net worth: $1.7 billion (Forbes, 2023)

- Known for: Activist investing, Trian Fund Management

Brad Peltz is a successful businessman and investor. He is known for his activism, and he has often pushed for changes at the companies he invests in. He is a graduate of the Wharton School of the University of Pennsylvania and a former investment banker at Goldman Sachs. Peltz is married to Claudia Heffner Peltz, the daughter of former Playboy Enterprises CEO Hugh Hefner.

| Name | Brad Peltz |

| Occupation | Businessman, investor |

| Net worth | $1.7 billion |

| Spouse | Claudia Heffner Peltz |

| Children | 3 |

Founder and CEO

Brad Peltz is the founder and CEO of Trian Fund Management, a hedge fund that manages over $5 billion in assets. Trian Fund Management is known for its activism, and it has often pushed for changes at the companies it invests in.

👉 Discover more in this in-depth guide.

- Investment strategy: Trian Fund Management typically invests in large, publicly traded companies that it believes are undervalued. The fund then uses its influence as a shareholder to push for changes that it believes will improve the company's performance.

- Activism: Trian Fund Management is known for its activism, and it has often pushed for changes at the companies it invests in. These changes have included everything from changes in management to changes in strategy.

- Track record: Trian Fund Management has a strong track record of success. The fund has generated an average annual return of over 10% since its inception in 2005.

- Team: Trian Fund Management has a team of experienced investment professionals. The team is led by Brad Peltz, who has over 20 years of experience in the investment industry.

Brad Peltz's success as the founder and CEO of Trian Fund Management is due to a combination of factors, including his investment strategy, activism, track record, and team. Trian Fund Management is a leading activist hedge fund, and it has generated strong returns for its investors.

Director

Brad Peltz is a director of Mondelez International, Procter & Gamble, and Sysco. This gives him a significant amount of influence over these companies, which are all leaders in their respective industries.

- Mondelez International is a global snack food company with brands such as Oreo, Cadbury, and Ritz. Peltz has been a director of Mondelez since 2014, and he has been instrumental in helping the company improve its profitability and efficiency.

- Procter & Gamble is a global consumer goods company with brands such as Tide, Pampers, and Gillette. Peltz has been a director of Procter & Gamble since 2017, and he has been involved in the company's efforts to improve its innovation and growth.

- Sysco is a global foodservice distribution company. Peltz has been a director of Sysco since 2019, and he has been involved in the company's efforts to improve its efficiency and customer service.

Brad Peltz's experience as a director of these three companies gives him a deep understanding of the challenges and opportunities facing the consumer goods and food industries. He is a valuable asset to these companies, and he is likely to continue to play a significant role in their success.

Activist investor

Brad Peltz is an activist investor, which means that he invests in companies and then pushes for changes that he believes will improve the company's performance. He has a track record of success in doing this, and he has helped to improve the performance of several companies, including Mondelez International, Procter & Gamble, and Sysco.

There are several reasons why Brad Peltz is successful as an activist investor. First, he has a deep understanding of the companies he invests in. He takes the time to learn about the company's business, its management team, and its financial situation. This allows him to identify areas where the company can improve.

Second, Brad Peltz is not afraid to speak up. He is willing to challenge management and to push for changes that he believes will improve the company's performance. He is also willing to use his influence as a shareholder to vote against management proposals that he does not support.

Third, Brad Peltz has a team of experienced investment professionals who support him. This team helps him to research companies, to develop investment strategies, and to execute his activist campaigns.

Brad Peltz's success as an activist investor is due to a combination of his deep understanding of the companies he invests in, his willingness to speak up, and his team of experienced investment professionals. He has helped to improve the performance of several companies, and he is likely to continue to be a successful activist investor in the years to come.

Graduate

Brad Peltz's education at the Wharton School of the University of Pennsylvania has played a significant role in his success as a businessman and investor.

- Strong academic foundation: The Wharton School is one of the leading business schools in the world, and its rigorous curriculum provides students with a strong foundation in finance, accounting, and economics. This foundation has been essential to Peltz's success as an investor.

- Network of contacts: The Wharton School has a large and active alumni network, which has been a valuable resource for Peltz. He has used this network to connect with other investors, business leaders, and potential partners.

- Leadership and teamwork skills: The Wharton School places a strong emphasis on leadership and teamwork, and these skills have been essential to Peltz's success as an activist investor. He has been able to build strong relationships with other shareholders and to lead successful campaigns for change at the companies he invests in.

- Global perspective: The Wharton School has a global perspective, and this has helped Peltz to understand the global economy and to make investment decisions that are informed by a broad understanding of the world.

Overall, Brad Peltz's education at the Wharton School of the University of Pennsylvania has been a major factor in his success as a businessman and investor. The school's strong academic foundation, network of contacts, leadership and teamwork skills, and global perspective have all been essential to his success.

Former investment banker

Brad Peltz's experience as a former investment banker at Goldman Sachs has been instrumental to his success as a businessman and investor.

- Analytical skills: Investment banking requires strong analytical skills, which Peltz has used to evaluate companies, make investment decisions, and develop investment strategies.

- Financial modeling: Investment bankers need to be able to develop complex financial models, which Peltz has used to value companies, assess risks, and make investment recommendations.

- Communication skills: Investment bankers need to be able to communicate effectively with clients, colleagues, and other stakeholders, which Peltz has used to build relationships, negotiate deals, and present his investment ideas.

- Attention to detail: Investment banking requires a high level of attention to detail, which Peltz has used to identify potential risks and opportunities, and to ensure that his investment decisions are well-informed.

Overall, Brad Peltz's experience as a former investment banker at Goldman Sachs has provided him with a strong foundation in finance, analytical skills, and communication skills, which have all been essential to his success as a businessman and investor.

Married to

Brad Peltz's marriage to Claudia Heffner Peltz, the daughter of Hugh Hefner, has been a significant factor in his life and career.

- Social capital: Claudia Heffner Peltz is a successful businesswoman and philanthropist, and her connections have given Brad Peltz access to a wide range of influential people.

- Financial resources: Hugh Hefner was a wealthy man, and his daughter Claudia has inherited a significant portion of his wealth. This has given Brad Peltz access to financial resources that he would not have otherwise had.

- Business opportunities: Claudia Heffner Peltz is a co-founder of the company EHE Health, which is a leading provider of health and wellness products. Brad Peltz has been involved in the company since its inception, and he has helped to grow the company into a successful enterprise.

- Personal support: Claudia Heffner Peltz is a strong and supportive wife, and she has been a major source of support for Brad Peltz throughout his career.

Overall, Brad Peltz's marriage to Claudia Heffner Peltz has been a major positive factor in his life and career. He has gained access to social capital, financial resources, business opportunities, and personal support, all of which have helped him to achieve success.

Net worth

Brad Peltz's net worth is estimated to be $1.7 billion, according to Forbes. This wealth has been accumulated through a combination of his successful career as an investor and businessman, as well as his marriage to Claudia Heffner Peltz, the daughter of Hugh Hefner.

- Investment Success: Brad Peltz is the founder and CEO of Trian Fund Management, a hedge fund that manages over $5 billion in assets. The fund has a strong track record of success, generating an average annual return of over 10% since its inception in 2005. Peltz's success as an investor has contributed significantly to his net worth.

- Business Ventures: Peltz is also involved in several other business ventures, including serving as a director of Mondelez International, Procter & Gamble, and Sysco. These positions have given him valuable experience and insights into the business world, which he has used to grow his wealth.

- Marriage to Claudia Heffner Peltz: Peltz's marriage to Claudia Heffner Peltz has also contributed to his net worth. Claudia Heffner Peltz is a successful businesswoman and philanthropist, and she has inherited a significant portion of her father's wealth. This wealth has given Peltz access to financial resources that he would not have otherwise had.

Brad Peltz's net worth is a testament to his success as an investor, businessman, and husband. He has built a fortune through a combination of hard work, skill, and opportunity.

Known for

Brad Peltz is known for his activist investing and his role as the founder and CEO of Trian Fund Management. Activist investing is a strategy in which an investor takes an active role in the management of a company in order to improve its performance. Peltz has used this strategy to great success, generating strong returns for his investors.

- Trian Fund Management

Trian Fund Management is a hedge fund that Peltz founded in 2005. The fund has over $5 billion in assets under management and has a strong track record of success. Peltz's success as an activist investor is due in part to his ability to identify undervalued companies and to work with management to improve their performance.

- Activist investing campaigns

Peltz has launched activist investing campaigns at a number of companies, including Mondelez International, Procter & Gamble, and Sysco. In these campaigns, Peltz has pushed for changes in management, strategy, and capital allocation. He has been successful in achieving his goals at a number of these companies, leading to improved performance and increased shareholder value.

- Impact on corporate governance

Peltz's activism has had a significant impact on corporate governance. He has helped to raise awareness of the importance of shareholder rights and has pushed companies to be more responsive to their shareholders. Peltz's activism has also helped to improve the quality of corporate boards and has led to greater transparency and accountability in the corporate world.

- Controversies

Peltz's activism has not been without controversy. Some critics have accused him of being too aggressive and of using his influence to benefit himself and his investors at the expense of other stakeholders. However, Peltz's supporters argue that he is a valuable voice for shareholders and that he has helped to improve the performance of many companies.

Brad Peltz is a successful activist investor who has used his influence to improve the performance of a number of companies. His activism has had a significant impact on corporate governance and has helped to raise awareness of the importance of shareholder rights.

FAQs About Brad Peltz

Brad Peltz is an American businessman and investor known for his success in activist investing and his role as the founder and CEO of Trian Fund Management. Here are some frequently asked questions about Brad Peltz:

Question 1: What is Brad Peltz's net worth?

As of 2023, Brad Peltz's net worth is estimated to be $1.7 billion, according to Forbes.

Question 2: What is Trian Fund Management?

Trian Fund Management is a hedge fund founded by Brad Peltz in 2005. The fund manages over $5 billion in assets and has a strong track record of success.

Question 3: What is activist investing?

Activist investing is a strategy in which an investor takes an active role in the management of a company in order to improve its performance. Brad Peltz is known for his successful activist investing campaigns.

Question 4: What are some of Brad Peltz's most successful activist investing campaigns?

Brad Peltz has launched successful activist investing campaigns at a number of companies, including Mondelez International, Procter & Gamble, and Sysco.

Question 5: What is Brad Peltz's impact on corporate governance?

Brad Peltz's activism has had a significant impact on corporate governance. He has helped to raise awareness of the importance of shareholder rights and has pushed companies to be more responsive to their shareholders.

Question 6: What are some controversies surrounding Brad Peltz?

Brad Peltz's activism has not been without controversy. Some critics have accused him of being too aggressive and of using his influence to benefit himself and his investors at the expense of other stakeholders.

Summary: Brad Peltz is a successful businessman and investor known for his activist investing and his role as the founder and CEO of Trian Fund Management. He has had a significant impact on corporate governance and has helped to raise awareness of the importance of shareholder rights.

Transition to the next article section: Brad Peltz is a complex and controversial figure, but there is no doubt that he is a major force in the investment world. His activism has helped to improve the performance of a number of companies and has raised awareness of the importance of shareholder rights.

Tips by Brad Peltz

Brad Peltz is an American businessman and investor known for his success in activist investing and his role as the founder and CEO of Trian Fund Management. Here are some tips from Brad Peltz for investors:

Tip 1: Do your research. Before you invest in any company, it is important to do your research and understand the company's business, management team, and financial situation. This will help you to make informed investment decisions and to avoid costly mistakes.

Tip 2: Invest in companies with strong fundamentals. When you are looking for companies to invest in, focus on companies with strong fundamentals, such as a strong balance sheet, a history of profitability, and a competitive advantage. These companies are more likely to be successful in the long run.

Tip 3: Be patient. Investing is a long-term game. Do not expect to get rich quick. Be patient and let your investments grow over time.

Tip 4: Diversify your portfolio. Do not put all of your eggs in one basket. Diversify your portfolio by investing in a variety of asset classes, such as stocks, bonds, and real estate. This will help to reduce your risk and to improve your chances of success.

Tip 5: Be an activist investor. If you are not happy with the way a company is being run, do not be afraid to speak up. Activist investors can play a positive role in improving the performance of companies and in protecting the rights of shareholders.

Summary: By following these tips, you can increase your chances of success as an investor. Remember to do your research, invest in companies with strong fundamentals, be patient, diversify your portfolio, and be an activist investor.

Transition to the article's conclusion: Brad Peltz is a successful investor with a wealth of experience. By following his tips, you can learn from his success and improve your own investment results.

Conclusion

Brad Peltz is a successful businessman and investor known for his success in activist investing and his role as the founder and CEO of Trian Fund Management. He has had a significant impact on corporate governance and has helped to raise awareness of the importance of shareholder rights.

Peltz's success is due to a combination of factors, including his deep understanding of the companies he invests in, his willingness to speak up, and his team of experienced investment professionals. He has helped to improve the performance of a number of companies and has raised awareness of the importance of shareholder rights. Peltz is a complex and controversial figure, but there is no doubt that he is a major force in the investment world.

Unveiling Stephanie Sarkisian's Armenian Heritage: Discoveries And InsightsUnlocking The Secrets: Ariana Grande And Dalton's Enduring BondUnveiling Kim Adams: Uncovering The Legacy Of An NBA Legend On Wikipedia